Complete your tax return the easy way Estimated Time 45 Mins!

We only ask you questions relevant to your circumstances.

Benefits Of Using Our Online Tax Return Application

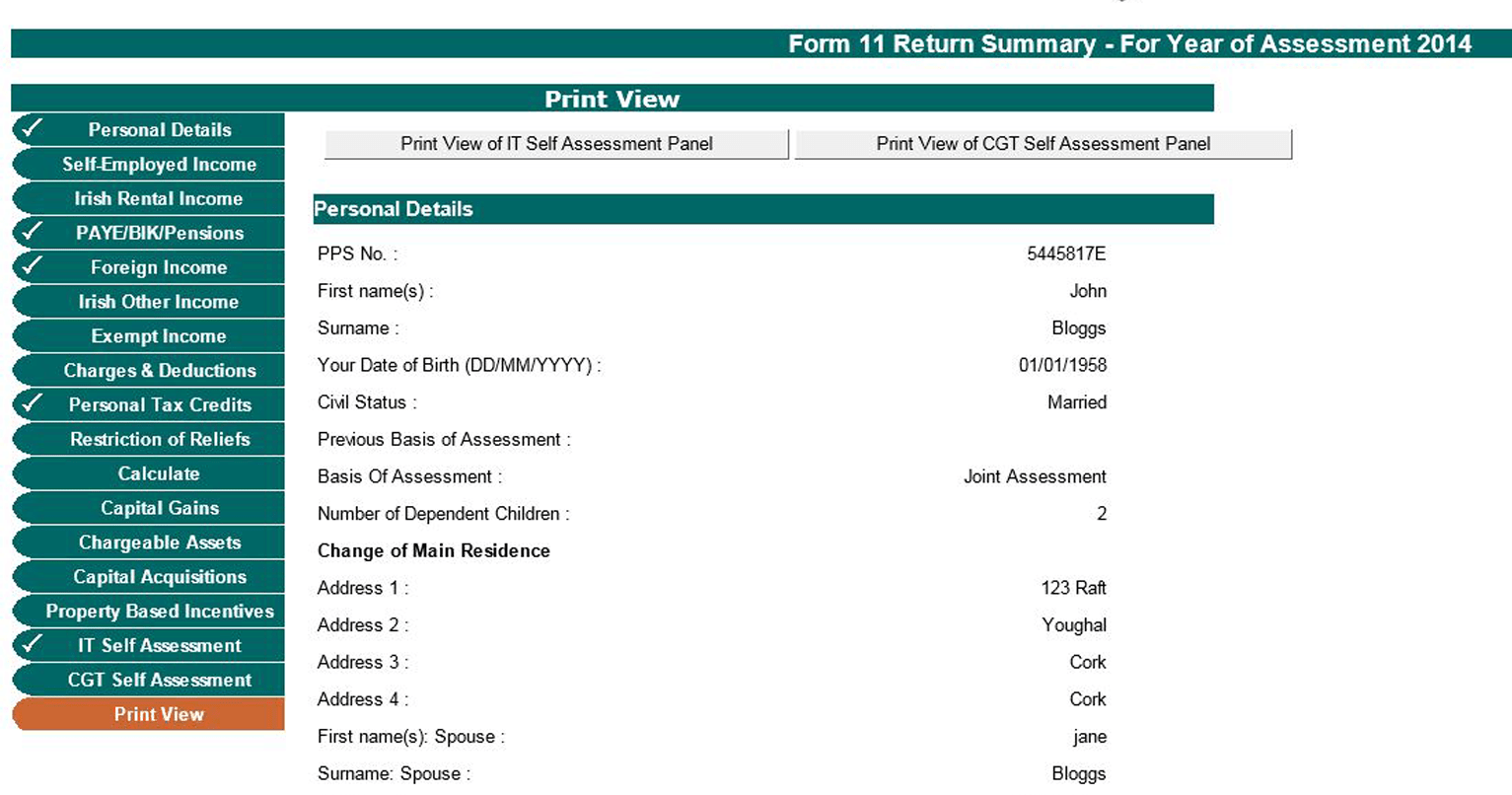

- We import your salary details direct from Revenue

- You don’t need to

- Spend hours searching for answers as we already have them,

- Be familiar with tax law,

- Be familiar with accountancy,

- Be familiar with tax terminology,

- Have a tax manual at your side,

- Spend hours on Google searching for answers,

- We guide you through entry of your

- PAYE Income,

- Self Employed income

- Property rental income

- and any other income sources that you have eg deposit interest, dividends

- Generate

- your Self Employed accounts

- your property rental accounts

- We prompt you for details

- of your tax deduction claims

- of your tax credits claims

- Enter details for your capital gains if any and calculate your capital gains tax

- Press the buttons for a detailed calculation of your tax position

- We tell you what tax you owe and how much preliminary tax to pay

- When tax form complete –

- For paper Tax Return Forms – Print, Sign & Post

- For E- Filing via Revenue Ros use our Ros file

- If you are on Service Plan 3 we do all of this for you

- Average time to complete 45 min’s from start to finish for existing customers

New Customers

We understand that new customers may take a bit longer and that’s why we are here to help you with full phone support combined with online prompts and videos. We will guide you through this process all of the way to completion of your tax return form.

Buy Now or Compare Price Plans

REVENUE

Irish Revenue ROS Agent

On Irish Revenue List of Software Providers